Open Positions

AAPL, NIHD, RIMM, BEBE, AKAM, GRMN, AEOS

Momentum WatchList

AAPL, NIHD, RIMM, BEBE, AKAM, GRMN, AEOS

Momentum WatchList

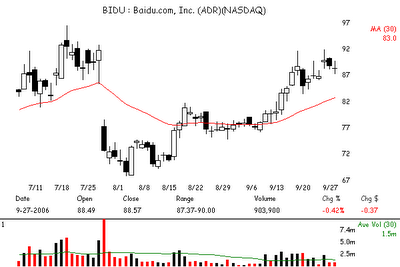

Tonights earnings will move this stock one way or the other. However, the current consolidation area which resembles like a classic DBOX, suggest that the line of least resistance is up. Next buy point to increase positions would be when it crosses the top of the box at around $90 after the earnings of course.

Tonights earnings will move this stock one way or the other. However, the current consolidation area which resembles like a classic DBOX, suggest that the line of least resistance is up. Next buy point to increase positions would be when it crosses the top of the box at around $90 after the earnings of course. This stock is sitting on the top of the 5 month basing area which is still buyable. If the market gets going, this top growth stock might start running to $70.

This stock is sitting on the top of the 5 month basing area which is still buyable. If the market gets going, this top growth stock might start running to $70.

There was no joy in momo land for BRCM traders yesterday as it broke above $31 and retraced to the bottom of the price range. Hitting a lot of stops. However, this could still move but might not be as powerfull as one might expect after having based for more than 5 weeks. Buy point is when it clears $31 again.

There was no joy in momo land for BRCM traders yesterday as it broke above $31 and retraced to the bottom of the price range. Hitting a lot of stops. However, this could still move but might not be as powerfull as one might expect after having based for more than 5 weeks. Buy point is when it clears $31 again.

Swing WatchList

After hitting my stop last week, I know that VIP will be back again in my radar. This time, a classic price pullback which gives me another shot at owning this stock. Buy point is when it clears yesterdays high at $62.05 with initial stop loss at $60.00 giving a risk of $2.05.

ICE - Buy above $72.35 with a stop below $70.50

No comments:

Post a Comment